The Startup Gig

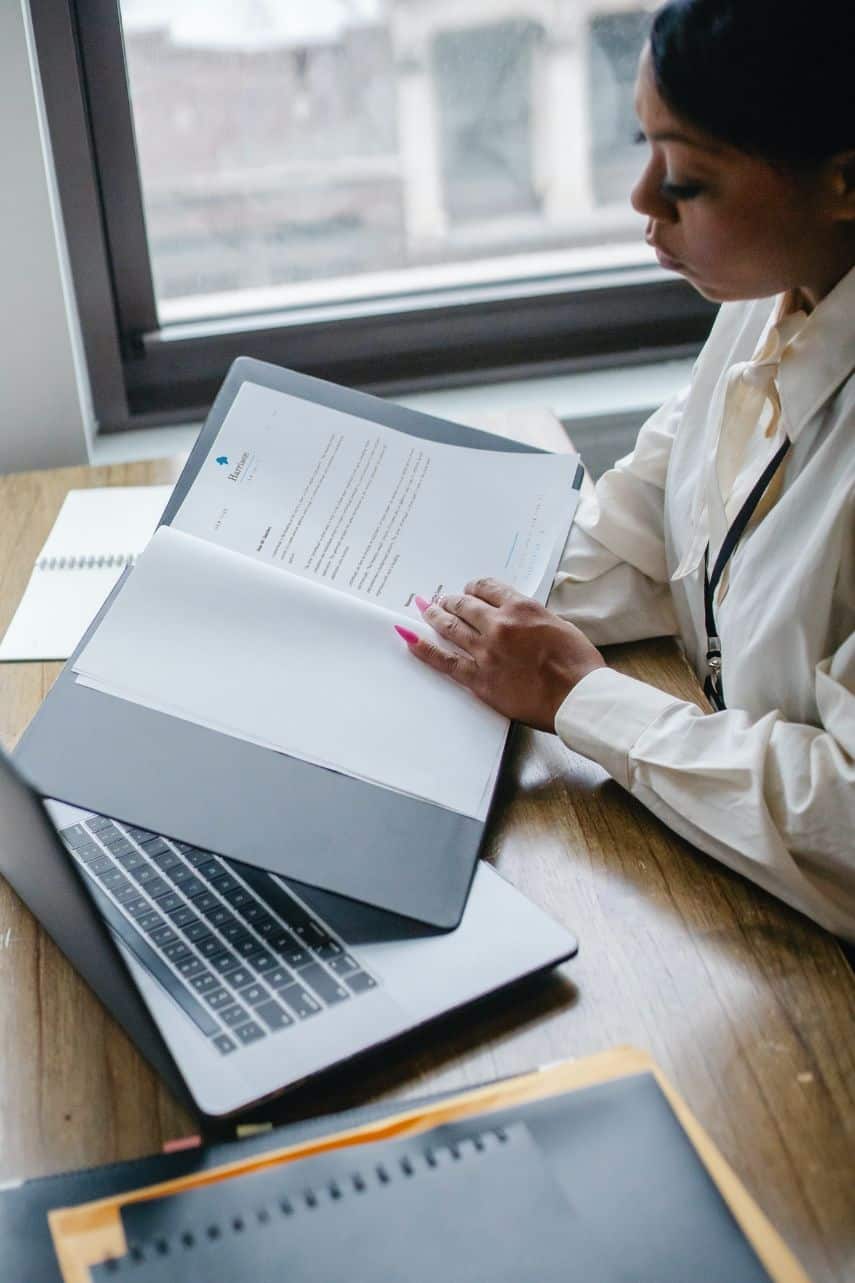

ESOP Advisory: Empowering Employees and Strengthening Businesses

Are you looking to attract top talents to your company while affording the liquidity to the company?

Overview of ESOP Services by THE Startup Gig

ESOP (Employee Stock Ownership Plan) services provided by THE Startup Gig encompass a range of offerings tailored to startups seeking to implement equity-based compensation plans for their employees.

ESOP serves as a means of rewarding company employees through stock option plans in addition to their fixed compensation. It allows eligible employees to purchase company stocks at a predetermined or discounted price.

Emerging companies typically encounter numerous legal considerations but often lack the personnel and financial resources to comprehensively address them all. Due to a shortage of in-house human resources and legal expertise, many emerging companies adopt a reactive approach to HR-related issues, only tackling problems as they arise.

Nevertheless, there are several common employment law issues where proactive understanding and planning can significantly reduce the risk of costly legal complications downstream.

Best ESOP Consultants

Comprehensive ESOP For Startups Solution

A Startup helping Startups

All Legal Solutions under one roof

4.9 Customer Rating

How do ESOPs benefit the employees and the employers?

ESOPs (Employee Stock Ownership Plans) offer various benefits to both employees and employers:

Benefits for Employees:

-

Ownership Stake: ESOPs provide employees with a sense of ownership in the company. By holding company stock, employees are more invested in the company’s success and may feel a stronger commitment to its long-term goals.

-

Financial Incentive: Employees have the opportunity to benefit financially from the company’s performance. As the company grows and the stock value increases, employees can see their stock holdings appreciate, potentially leading to significant financial gains.

-

Alignment of Interests: ESOPs align the interests of employees with those of the company and its shareholders. When employees are also shareholders, they are more likely to make decisions that benefit the company’s overall performance and value.

-

Retention Tool: ESOPs can be an effective tool for retaining top talent. Employees may be more inclined to stay with the company if they have a vested interest in its success and see the potential for financial rewards through their stock holdings.

Benefits for Employers:

-

Employee Motivation and Engagement: ESOPs can boost employee morale, motivation, and engagement. When employees have a stake in the company’s success, they are often more motivated to work hard, innovate, and contribute to the company’s growth.

-

Recruitment Tool: Offering an ESOP can make a company more attractive to prospective employees. The opportunity to own a stake in the company can be a compelling incentive for talented individuals to join the organization.

-

Retention and Loyalty: ESOPs can help companies retain key employees over the long term. Employees who have a financial interest in the company are less likely to leave, reducing turnover and the costs associated with recruiting and training new staff.

-

Tax Benefits: In some cases, ESOPs offer tax advantages for both the company and its employees. Contributions to the ESOP may be tax-deductible for the employer, while employees may enjoy tax-deferred growth on their stock holdings until they are eventually sold.

The legal framework governing ESOPs in India

The issuance of ESOPs is governed under Section 62(1)(b) of the Companies Act, 2013. It reads

S.62: Further issue of share capital.—(1) Where at any time, a company having a share capital proposes to increase its subscribed capital by the issue of further shares, such shares shall be offered –

(b) to employees under a scheme of employees‘ stock option, subject to special resolution passed by company and subject to such conditions as may be prescribed.

What kinds of employees are eligible for ESOPs?

According to Rule 12 of the Companies (Share Capital and Debenture) Rules, 2014, the following individuals are eligible for ESOPs:

(a) A permanent employee of the company who has been working in India or outside India;

(b) A director of the company, whether a whole-time director or not, but excluding an independent director;

(c) An employee defined in clause (a) or (b) of a subsidiary, in India or outside India, or of a holding company of the company.

However, this does not include:

(i) An employee who is a promoter or a person belonging to the promoter group;

(ii) A director who, either personally or through a relative or any corporate body, directly or indirectly, holds more than ten percent of the outstanding equity shares of the company.

In the case of a start-up company, the conditions specified in sub-clauses (i) and (ii) shall not apply for up to five years from the date of its incorporation or registration.

This is as defined in notification number GSR 180(E), dated 17th February 2016, issued by the Department of Industrial Policy and Promotion, Ministry of Commerce and Industry, Government of India.

Testimonial

Frequently Asked Questions for ESOP for Startup

1. What is an ESOP, and why should my startup consider it?

An Employee Stock Ownership Plan (ESOP) gives employees a stake in your company. It’s a great way to boost motivation, attract talent, and create long-term commitment.

2. How do I decide how much equity to allocate for ESOPs?

It depends on your stage, hiring plans, and investor expectations. Typically, startups allocate 10–20% of equity. A balanced approach keeps your team motivated while protecting control of your company.

3. Can ESOPs help retain talent in my startup?

Definitely. ESOPs give employees a tangible stake in your success, which can improve loyalty and reduce turnover , a critical advantage for startups.

4. What are the tax implications of ESOPs in India?

There are two stages of taxation:

- At exercise, taxed as a perquisite (difference between FMV and exercise price).

- At sale, taxed as capital gains. Proper planning helps minimize tax burdens for both employees and the startup.

5. Can ESOPs be given to consultants or advisors?

Yes, they can. Many startups extend ESOPs to advisors to reward valuable contributions without impacting cash flow, but legal compliance and clear terms are crucial.

6. How long does it take to set up an ESOP plan?

Depending on complexity, it usually takes a few weeks to a couple of months. It involves plan design, valuation, legal documentation, and communication with employees.

7. Will an ESOP affect my startup’s funding rounds?

Yes. Investors often look closely at your ESOP pool size since it affects share dilution. A well-structured plan can make funding smoother and more attractive to investors.

8. How do I communicate the value of ESOPs to my employees?

Transparency is key. Explaining how the plan works, its benefits, and how it contributes to wealth creation helps employees appreciate and engage with the program.

9. What happens if a key employee leaves before their shares vest?

Unvested shares are usually forfeited. ESOP agreements define vesting schedules, exit terms, and conditions clearly to protect both the startup and the employee.

10. How can The Startup Gig help with ESOPs?

We offer full ESOP advisory services , from structuring and valuation to compliance, documentation, and ongoing management , ensuring your ESOP aligns with growth and retention goals.

Read More

ESOP SERVICE FOR STARTUP

Employers seeking to match employee interests with the organization’s long-term objectives are increasingly using employee stock ownership plans, or ESOPs, as a strategic tool. ESOP advisory services provide businesses with expert guidance in designing, implementing, and managing these plans, ensuring that both the company and its employees benefit.

At The Startup Gig, we specialize in offering comprehensive ESOP advisory services tailored to the unique needs of each business. Our team of experienced professionals ensures that your ESOP plan/scheme is structured effectively, complies with regulatory requirements, and fosters employee engagement.

Why Choose ESOP Consultants in India?

For companies that want to successfully manage the challenges of establishing and sustaining ESOPs, collaborating with ESOP consultants in India is essential. These consultants offer valuable insights into the legal, financial, and administrative aspects of ESOPs, ensuring that the plans are beneficial for both the company and its employees.

ESOP consultants in India also help businesses understand the tax implications, valuation processes, and regulatory compliance involved in establishing an ESOP. Their knowledge enables businesses to design strategies that foster long-term growth while also attracting and keeping outstanding personnel.

Partner with the Best ESOP Consultant in India

Choosing the best ESOP consultant in India will help you to maximize the benefits of your ESOP plan. At The Startup Gig, we take great pride in being a reliable business partner to companies in a range of sectors. Our team of experts works closely with your company to design and implement ESOPs that align with your strategic objectives.

Our dedication to offering individualized services that cater to the unique needs of each client has earned us the reputation of being the best ESOP consultant in India. Whether you are a startup or an established enterprise, we have the expertise to guide you through the entire ESOP lifecycle.

Specialized ESOP Consultants in Mumbai

For businesses located in Mumbai, working with specialized ESOP consultants in Mumbai can offer significant advantages. The Startup Gig has a deep understanding of the local market and regulatory environment, making us the go-to choice for companies seeking expert ESOP advisory in the region.

Our team of ESOP consultants in Mumbai is dedicated to helping businesses create and manage ESOPs that drive employee engagement and contribute to the overall success of the organization. With our extensive experience and local knowledge, we ensure that your ESOP plan is both effective and compliant with all relevant regulations.

Comprehensive ESOP Advisory Services by Startup Gig

At The Startup Gig, we offer a full range of ESOP advisory services, including:

- Plan Design and Structuring: We work with you to design an ESOP that meets your company’s goals and objectives while ensuring compliance with legal and regulatory requirements.

- Valuation and Financial Analysis: Our experts provide accurate valuations and financial analysis to determine the appropriate allocation of shares to employees.

- Regulatory Compliance: To reduce the possibility of legal problems, we make sure your ESOP plan adheres with all applicable laws and regulations.

- Employee Communication and Engagement: We assist in communicating the benefits of the ESOP to your employees, helping to foster a culture of ownership and long-term commitment.

- Ongoing Support and Management: To make sure that your ESOP strategy stays relevant to your business goals and develops with your organization, our staff offers continuous support.

Choosing The Startup Gig for ESOP advisory gives you access to a group of devoted experts who are invested in the success of your company. Whether you need expert guidance in plan/ scheme design, valuation, or compliance, we have the knowledge and experience to deliver results.