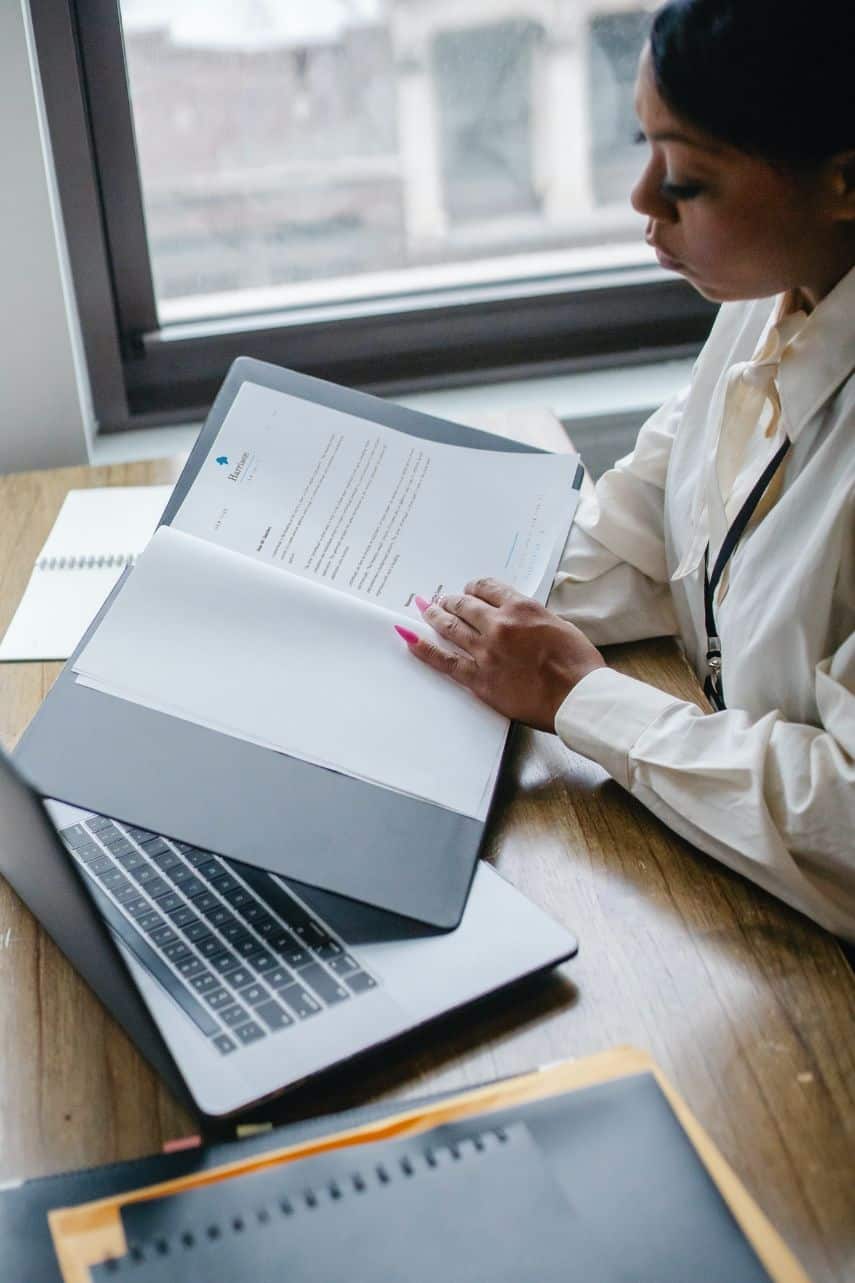

The Startup Gig

ESOP SERVICE FOR STARTUP

Are you looking to attract top talents to your company while affording the liquidity to the company?

Overview of ESOP Services by THE Startup Gig

ESOP (Employee Stock Ownership Plan) services provided by THE Startup Gig encompass a range of offerings tailored to startups seeking to implement equity-based compensation plans for their employees.

ESOP serves as a means of rewarding company employees through stock option plans in addition to their fixed compensation. It allows eligible employees to purchase company stocks at a predetermined or discounted price.

Emerging companies typically encounter numerous legal considerations but often lack the personnel and financial resources to comprehensively address them all. Due to a shortage of in-house human resources and legal expertise, many emerging companies adopt a reactive approach to HR-related issues, only tackling problems as they arise.

Nevertheless, there are several common employment law issues where proactive understanding and planning can significantly reduce the risk of costly legal complications downstream.

Best ESOP Consultants

Comprehensive ESOP For Startups Solution

A Startup helping Startups

All Legal Solutions under one roof

4.9 Customer Rating

How do ESOPs benefit the employees and the employers?

ESOPs (Employee Stock Ownership Plans) offer various benefits to both employees and employers:

Benefits for Employees:

-

Ownership Stake: ESOPs provide employees with a sense of ownership in the company. By holding company stock, employees are more invested in the company’s success and may feel a stronger commitment to its long-term goals.

-

Financial Incentive: Employees have the opportunity to benefit financially from the company’s performance. As the company grows and the stock value increases, employees can see their stock holdings appreciate, potentially leading to significant financial gains.

-

Alignment of Interests: ESOPs align the interests of employees with those of the company and its shareholders. When employees are also shareholders, they are more likely to make decisions that benefit the company’s overall performance and value.

-

Retention Tool: ESOPs can be an effective tool for retaining top talent. Employees may be more inclined to stay with the company if they have a vested interest in its success and see the potential for financial rewards through their stock holdings.

Benefits for Employers:

-

Employee Motivation and Engagement: ESOPs can boost employee morale, motivation, and engagement. When employees have a stake in the company’s success, they are often more motivated to work hard, innovate, and contribute to the company’s growth.

-

Recruitment Tool: Offering an ESOP can make a company more attractive to prospective employees. The opportunity to own a stake in the company can be a compelling incentive for talented individuals to join the organization.

-

Retention and Loyalty: ESOPs can help companies retain key employees over the long term. Employees who have a financial interest in the company are less likely to leave, reducing turnover and the costs associated with recruiting and training new staff.

-

Tax Benefits: In some cases, ESOPs offer tax advantages for both the company and its employees. Contributions to the ESOP may be tax-deductible for the employer, while employees may enjoy tax-deferred growth on their stock holdings until they are eventually sold.

The legal framework governing ESOPs in India

The issuance of ESOPs is governed under Section 62(1)(b) of the Companies Act, 2013. It reads

S.62: Further issue of share capital.—(1) Where at any time, a company having a share capital proposes to increase its subscribed capital by the issue of further shares, such shares shall be offered –

(b) to employees under a scheme of employees‘ stock option, subject to special resolution passed by company and subject to such conditions as may be prescribed.

What kinds of employees are eligible for ESOPs?

According to Rule 12 of the Companies (Share Capital and Debenture) Rules, 2014, the following individuals are eligible for ESOPs:

(a) A permanent employee of the company who has been working in India or outside India;

(b) A director of the company, whether a whole-time director or not, but excluding an independent director;

(c) An employee defined in clause (a) or (b) of a subsidiary, in India or outside India, or of a holding company of the company.

However, this does not include:

(i) An employee who is a promoter or a person belonging to the promoter group;

(ii) A director who, either personally or through a relative or any corporate body, directly or indirectly, holds more than ten percent of the outstanding equity shares of the company.

In the case of a start-up company, the conditions specified in sub-clauses (i) and (ii) shall not apply for up to five years from the date of its incorporation or registration.

This is as defined in notification number GSR 180(E), dated 17th February 2016, issued by the Department of Industrial Policy and Promotion, Ministry of Commerce and Industry, Government of India.